The International Energy Agency (IEA) released the latest annual edition of its landmark World Energy Outlook (WEO) this week. The WEO is used by researchers, academics and policy-makers worldwide to assess how our energy system is currently functioning, how it may evolve in the coming decades, and what policies and regulations can be put in place to shape its future in the way governments want.

What is clear from this year’s WEO is that the scale and pace of the global shift to clean energy production and use is no longer only about governments seeking to achieve their climate goals. The IEA points out that many countries around the world have experienced the effects on their populations of high fossil fuel and electricity prices, as well as extreme weather events in the last couple of years. This has meant that, in some places – just as we are seeing in Canada – cost of living concerns are dominating the public conversation about climate and energy policy. But, the IEA says, there is now so much economic opportunity associated with the energy transition that “cost drivers, as well as intense competition for leadership in clean energy sectors that are major sources of innovation, economic growth and employment” are seeing governments continue to push ahead. In this context, the energy transition is better understood as a second industrial revolution – where those who adopt new, clean technologies early and at scale are positioning themselves to reap the economic and social benefits.

This is what we at the Pembina Institute like to call the new energy economy, where simple market forces and technological advances are driving a shift to low-carbon models of economic growth. And there is a clear takeaway for Canada’s federal and provincial governments: not only is the energy transition going to help us avoid the worst impacts of climate change, it has the potential to make our lives more affordable, the homes and cities we live in more healthy and comfortable, and create new sectors and jobs that will help grow our economy in the long term.

Read more about how the IEA puts together its scenarios (not predictions) of the world's energy future

In the WEO, the IEA presents three scenarios for how the global energy system may evolve in the coming decades:

- The Stated Policies Scenario (STEPS) examines the impacts of policies that governments have already implemented. This is the least ambitious scenario – it is useful to think of it in terms of “if we did nothing more than what we’re already doing, how would our energy system look in the next few years?”

- The Announced Pledges Scenario (APS) speeds up that transition and assumes that all announced climate commitments and targets around the world will be met in full and on time. This is different from STEPS in that it includes the possibility that governments will implement more policies than those they’ve already put in place.

- The Net Zero Emissions by 2050 Scenario (NZE) is a cost-effective pathway modelled by the IEA, through which the world’s energy sector would achieve net-zero emissions by 2050, and emissions would be reduced to a level where we would have a 50% chance of limiting global warming to 1.5 degrees Celsius above pre-industrial levels. The 1.5 degree target has been identified by scientists as a crucial threshold, beyond which we risk more severe impacts on global ecosystems.

Crucially, the IEA’s scenarios are not predictions. They are modelled trajectories that use data to highlight key trends, uncertainties, and potential outcomes. They can help us stay on track with our climate goals and identify where more work needs to be done.

Speeding into the "Age of Electricity"

The biggest message from this year’s WEO is that governments must not underestimate the crucial role that access to abundant clean electricity will have in their economic growth over the next several decades – something the IEA is calling the "Age of Electricity."

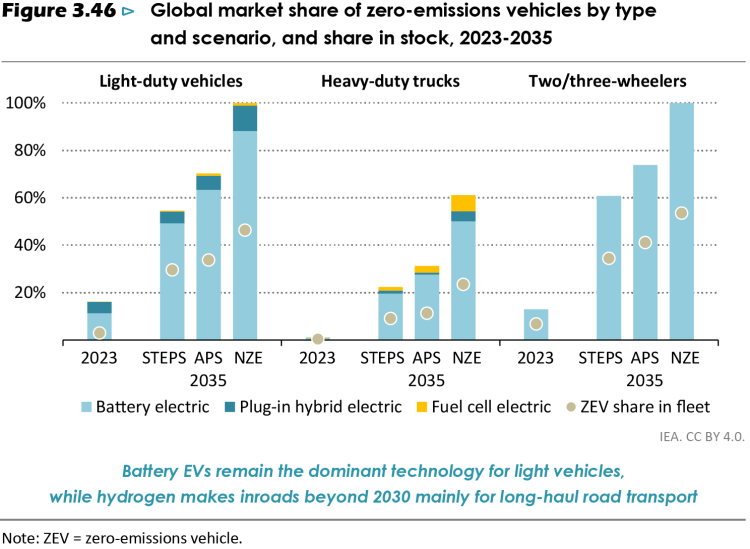

The report shows that ever more of the world’s everyday energy uses are starting to be powered by electricity instead of fossil fuels. For example, over 7 million electric vehicles were sold worldwide in the first half of 2024, representing an increase of nearly 25% compared to the same period a year ago. While China is behind most of this increase – and is expected to continue to dominate global growth – sales are still growing in other markets. In Canada, 114,114 electric vehicles were sold in the first half of 2024, representing a 45% increase on the first half of 2023 (when 78,660 electric vehicles were sold).

The report notes that falling battery prices have prompted automakers to reduce EV sticker prices, and that automakers remain committed to EVs, with their long-term plans pointing to the production of over 40 million electric vehicles per year by 2030. This has the potential to be a major job creator in Canada, where automakers and governments have set targets and made big investments in EV production and manufacturing. But Canada needs to stick with policies that improve the supply and affordability of EVs, such as purchase incentives, sales regulations and the rollout of charging infrastructure. Ensuring the strongest possible domestic market for EVs will be critical in both bolstering the auto manufacturing sector in Canada and enabling Canadians to participate in a clean transportation future – and the added benefits this will bring of less pollution in our towns and cities, as well as owning vehicles that are cheaper to run.

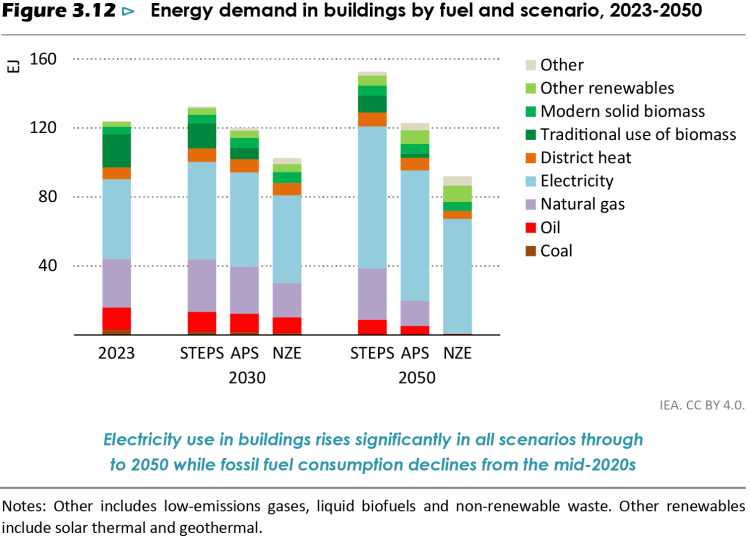

Another major driver of electrification noted by the IEA is home heating and cooling which, under STEPS, is forecasted to be responsible for 45% of electricity demand growth by 2035. In fact, cooling is more the focus – with a warming climate meaning demand for home cooling is set to increase and overtake heating requirements in many countries, including Canada. In all of the IEA’s scenarios, this demand is met with an increasing share of electricity use (through, for example, adoption of electric heat pumps) as opposed to fossil fuels such as natural gas-powered furnaces. Under STEPS, the global market share of heat pumps doubles to 24% by 2035, under APS it reaches approximately 30%, and under NZE it reaches 40%.

Again, this is at least in part being driven by the availability of new technologies and the falling cost associated with them. The IEA notes that heat pumps are already one of the most cost-effective options for heating and cooling, even in markets where the cost of natural gas is relatively low (such as the United States). They also require skilled workers to install them – pointing to the job creation opportunity associated with heat pump adoption, if governments have the foresight to invest in upskilling and reskilling the labour force.

And also...the age of efficiency?

Additional demand for electricity brings up two things – the need to rapidly expand our supply of clean electricity, but also to make sure the electricity we have is used as efficiently as possible. The IEA points out that all governments should tighten appliance efficiency standards; in other words, ensure that everything you plug in at home – from your electric stove, to your dishwasher, to your lightbulbs – should be running as efficiently as possible. To get ahead of this, Canada’s governments should look at ways to increase equipment efficiency standards, as well as make reforms to building codes to ensure the homes we live in are as energy efficient as possible (which will also make them more comfortable and reduce most Canadians’ utility bills). Plus, again, creating a market for home retrofits is another area for employment in the new energy economy – these would be some of the 700,000 jobs that the Pembina Institute estimates could be created between 2025 and 2050 as a result of the energy transition.

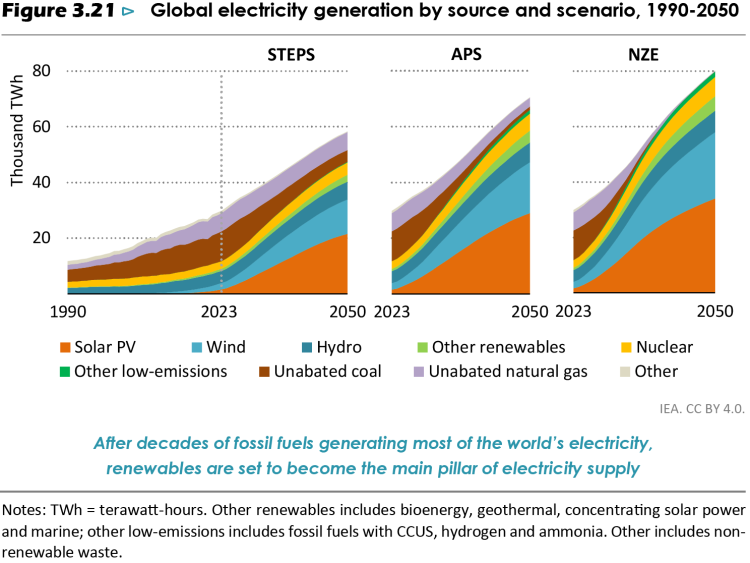

The clean electricity race

In 2023, 30% of all global energy came from renewables (which in this instance means solar, wind, hydro, bioenergy, geothermal and marine). In STEPS, the IEA forecasts this will rise to 47% by the end of this decade, rising further to 51% in APS – and 59% in NZE. This is a continuation of a trend already underway, driven in part by the fact that wind and solar are now the most cost-effective sources of electricity in most markets. Those two technologies alone accounted for 43% of global electricity growth from 2010 to 2023.

There has been consternation across Canada in the last couple of years about the federal government’s pledge to achieve a net-zero electricity grid by 2035, and the proposed Clean Electricity Regulations that will help get us there. But the WEO shows that Canada really has no time to lose – we are competing with other highly industrialized nations for clean electricity growth, as well as the investment that follows from companies who want access to that clean, affordable power. Much has been made recently, for example, of big tech companies that are seeking out massive amounts of clean power to run data centres; that investment is clearly there for the taking of jurisdictions that prioritize clean electricity supplies.

It’s also important to note that the Clean Electricity Regulations are not only about clean forms of generation – they are also about modernizing Canada’s grid and adopting measures to bolster the reliability of renewables, so that we aren’t just relying on more expensive alternatives to fill in any supply gaps, such as natural gas paired with carbon capture. Looking at the WEO, the stated purpose of the Clean Electricity Regulations appears to be meeting the moment, as the IEA states there is a need for governments to encourage investment in transmission and other grid infrastructure, including battery storage. Right now, for every dollar spent globally on renewable power, 60 cents are spent on grids and batteries.

Nevertheless, while there are two major holdouts on the Clean Electricity Regulations and the large scale build out of renewables – Alberta and Saskatchewan – it is worth remembering that the majority of Canada is already demonstrating that it has understood that generating clean electricity in abundance can translate into investment, jobs and economic growth:

- Ontario, for example, adopted the Powering Ontario’s Growth clean energy plan in 2023 and has shown great leadership, achieving an 89% emissions free grid. The province was the first to phase out coal almost a decade ago while recent announcements indicate a promising continuation of the prioritization of non-emitting sources, upholding Ontario’s reputation as a clean energy powerhouse and attracting impressive investments by industry including Volkswagen Group and Honda. This year alone, Ontario launched its largest competitive energy procurement for clean electricity, began work on the biggest battery storage plant in Canada, announced commitments to refurbish existing hydroelectricity plants, and is advancing the largest Indigenous-led transmission line project. It will be critical for the province to continue to power its growth through non-emitting sources, rather than investing in natural gas fired facilities.

- British Columbia launched a new clean energy strategy in June 2024, committing to reducing emissions 40% by 2030, embrace innovation and use existing energy more efficiently. The province’s flow of legacy hydro has historically supported a reliable and affordable grid for British Columbians. However, the province anticipates potentially needing to double its generation capacity by 2050 – and its first competitive call for power in fifteen years saw three times more applications than the province expected, representing enough power for almost 800,000 homes. The province is also investing in updating its grid by expanding and strengthening its transmission, while the implementation of the Zero Carbon Step Code (ZCSC) has introduced Canada’s first carbon pollution standard for buildings.

- In Quebec, the provincial government has mandated Quebec Hydro to rapidly expand wind and solar power by more than 10 GW by 2030. It is combining more generation with additional energy efficiency measures – including funding home retrofits and other efficiency measures – to free up 3.5 GW of demand. By 2035, this will require investments between $155 billion and $185 billion and create 35,000 jobs. Meanwhile, its trade partnership with Ontario is supporting interprovincial transmission links, which has increased grid reliability for both provinces during peak consumption.

- Finally, Nova Scotia is also on the right track, pursuing decarbonization efforts through an all-hands-on-deck approach to integrate more renewables, energy storage and transmission, as well as an innovative community solar program that offers support for consumers looking to procure long-term renewable electricity. The province has also announced its support of the federal Clean Electricity Regulations.

With an election looming, the next federal government has the opportunity to bring the remaining provinces onside and seize the global competitive advantage that Canada already enjoys. After all, over 80% of power generation in Canada already comes from renewables or nuclear power. By comparison, about 60% of electricity in the United States is still generated by fossil fuel power plants. The lesson from the WEO is: while Canada starts from a comparatively good place in terms of clean electricity, we’ll soon lose that advantage if we don’t move forward with expanding our grid and ensuring that supply of low-carbon generation truly extends from coast to coast to coast.

A leaner, cleaner oil and gas sector

Fossil fuels – oil, gas and coal – are still meeting the lion’s share of the world’s energy demand (80% in 2023), although the trajectory of oil and natural gas demand seems to be shifting in the 2030’s. Amidst all this, the picture for fossil fuels is not straightforward and significant uncertainty remains, particularly for natural gas.

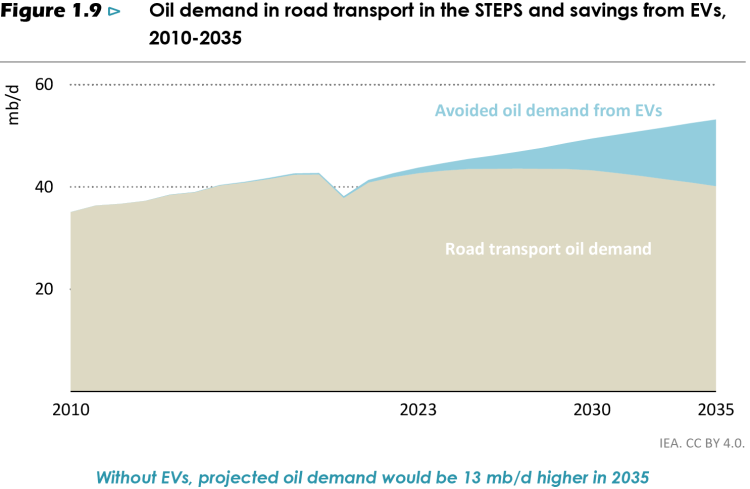

Demand growth for oil is already beginning to slow, and overall demand is expected to peak before 2030, in all scenarios, largely because of EV adoption. EV adoption under STEPS, for example, is forecast to reduce oil demand by 13 million barrels per day by 2035. In Canada, this is a reminder that competition amongst oil producers is going to rapidly intensify in the next few years – and that both the cost and carbon-competitiveness of oil production is likely to become more important. This reinforces the case for regulation of the sector’s emissions, especially given that, at present, Canada’s oilsands production is some of the highest cost and most carbon-intensive, globally.

Meanwhile, the IEA has revised the demand for natural gas upward in all scenarios– particularly liquefied natural gas (LNG) – in this year’s WEO compared with the 2023 report, reflecting stronger-than-anticipated demand in China and the Middle East. But there is a note of caution about the amount of new LNG export infrastructure being built and opened in the next few years, with LNG capacity set to increase by 50% as a result of planned projects – many of which are in the United States and Qatar, but some of which are in Canada. Once the costs of liquefaction, shipping, and regasification are realized, LNG becomes relatively expensive, indicating that developing economies may not favour a switch to natural gas at scale. This therefore highlights the possibility of suppliers facing a lot of competition for market access, which will be particularly risky for new projects – like some of those due to be constructed on Canada’s west coast – that on average have higher costs than existing projects which have already paid off their initial investment. Investors, and governments, will need to consider carefully how LNG fits into their plans to both reduce emissions and generate revenues in a low-carbon world – and the possibility that LNG projects in the pipeline today could quickly become stranded assets, given the pace at which clean electricity generation capacity is also continuing to grow each year.