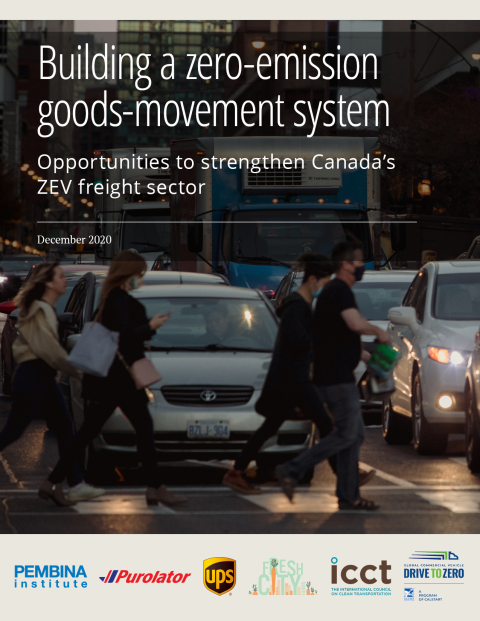

As urbanization, economic activity, online shopping, and the demand for same-day and home deliveries increase, the number of delivery trucks and vans on the streets of Canada’s cities is also growing. Now is the time to consider what the proliferation of delivery trucks is doing to the air that Canadians breathe, and the impact those vehicles are having on global warming.

Based on a review by the Pembina Institute of the policies implemented to promote the use of zero-emission delivery vehicles within six of the largest Canadian municipalities as well as the policies of their respective provincial governments and the federal government, it is clear that an integrated and comprehensive approach is required to support the shift to low-carbon urban delivery.

This report, a publication of the Urban Delivery Solutions Initiative, identifies 10 opportunities to support the expansion of zero-emission vehicles for goods movement, and to help Canada achieve its 2030 and 2050 climate targets.

Executive summary

As urbanization, economic activity, online shopping, and the demand for same-day and home deliveries increase, the number of delivery trucks and vans on the streets of Canada’s cities is also growing. The COVID-19 pandemic is prompting more Canadians to buy online, which will only escalate truck traffic in urban areas. Now is the time to consider what the proliferation of delivery trucks is doing to the air that Canadians breathe, and the impact those vehicles are having on global warming.

The transportation sector represents a quarter of the country’s greenhouse gas emissions. Emissions from the transportation sector are notoriously difficult to tackle because the carbon footprint of passenger and freight movement originates from millions of different sources of pollution — cars, SUVs, buses, trains, heavy-duty trucks, ships, and planes. Freight sources represent 42% of national transportation emissions, and, by 2030, freight emissions are expected to surpass passenger-vehicle emissions in Canada. To respond to impacts of climate change and to better manage transport-related GHG emissions, businesses with large fleet operations need to reduce their carbon footprint, and, ideally, transition to zero-emission vehicles.

But there are considerable gaps that must be filled to support an integrated clean transportation and energy system. Such a system is needed if Canada is to meet its climate goals. Canada has committed, under the Paris Agreement, to a reduction of greenhouse gas emissions by 30% below 2005 levels as of 2030. More recently, the federal government has pledged to achieve net-zero greenhouse gas emissions as of 2050.

This report evaluates the current policy landscape pertaining to zero-emission vehicles and identifies opportunities to cultivate and sustain a zero-emission goods-movement system in Canada. There is currently no national zero-emission vehicle policy and investment strategy for goods movement, from last-mile deliveries to the heavy-duty freight sector. In the absence of such a strategy, market transformation has been slow, even for those companies that are eager to make the changes necessary for a clean economy.

Zero-emission vehicles (ZEVs) are defined as vehicles that have the potential to produce zero tailpipe emissions. These include battery-electric vehicles, plug-in hybrid electric vehicles, and hydrogen fuel cell vehicles. This report focuses on the electrification of vehicles used in urban deliveries, especially over the short term, and examines a range of vehicle types deployed for that purpose (light-, medium- and heavy-duty vehicles).

Based on a review by the Pembina Institute of the policies implemented to promote the use of zero-emission delivery vehicles within six of the largest Canadian municipalities (Vancouver, Calgary, Edmonton, Toronto, Montreal, and Halifax) as well as the policies of their respective provincial governments and the federal government, it is clear that an integrated and comprehensive approach is required to support the shift to low-carbon urban delivery. Change would be accelerated by action from all levels of government, and commitment of industry, to establish long-term strategic plans and set targets, to provide incentives for vehicle procurement and associated capital infrastructure, and to cultivate skills required to develop and maintain these fleets.

The Technical Appendix offers an inventory of federal policies and programs, as well as those in effect at the provincial and municipal levels, that support ZEV adoption for goods-movement purposes in these six major Canadian cities.

Opportunities

The ZEV policy landscape can be divided into four categories: long-range strategic planning and regulations; incentives (financial and non-financial) for vehicle procurement and widespread deployment; charging infrastructure; and fleet-capacity development. Each of these categories require investments to support the development of an integrated zero-emission transportation system. With that in mind, this report identifies ten opportunities to support the expansion of zero-emission vehicles for goods movement, and to help Canada achieve its 2030 and 2050 climate targets.

![]()

Strategic planning and regulations

Governments at all levels have the power and a role to play to propel the goods-movement industry toward practices that will lead to reduced emissions, cleaner air, and a sustainable environment. Long-range strategic planning and regulations can help ensure policies are consistent, effective, and co-ordinated and implemented in a manner that is accountable and transparent.

Opportunity #1: Co-ordinated ZEV strategies for commercial vehicles — along with associated long-term investment plans — promote uptake within goods-movement fleets. Sales mandates for medium- and heavy-duty vehicles are effective tools in speeding the transition to clean freight delivery.

Incentives for deployment

The “carrot” approach has proved effective in incentivizing the movement to clean transportation. Both financial incentives and non-financial actions are crucial to reduce barriers and accelerate the widespread deployment of electric vehicles.

Opportunity #2: If Canada set a target of 25,000 new zero-emission medium- and heavy-duty vehicles by 2025, a total investment of about $5 billion would be required for vehicle procurement alone — a cost that could be shared across sectors. Currently, the federal government's Incentives for Zero-Emission Vehicles program does not include medium- and heavy-duty commercial vehicles.

Opportunity #3: Increased transparency and certainty on the long-term renewal of government financial incentives would provide increased ability for the freight delivery industry to plan its transition to zero-emission vehicles over time.

Opportunity #4: Expanding non-financial mechanisms, such as green licence plate programs, that give preferential treatment to zero-emission vehicles, to commercial vehicles, could encourage the transition to low-emission fleets.

Opportunity #5: Commercial fleet operators would be more likely to move to ZEV fleets if municipalities restricted the travel of high-polluting vehicles, over time, and set targets for emission reductions that align with Canada’s decarbonization goals.

Opportunity #6: Municipalities have the authority to implement curbside management tactics, which could incent commercial ZEV uptake.

Charging infrastructure

The operators of zero-emission fleets need to know their vehicles will be able to recharge at convenient times and locations. Continued investment can support the buildout of depot and private charging infrastructure, with public infrastructure programs designed to maximize applicability to goods-delivery fleets.

Opportunity #7: If Canada set a target of 25,000 new zero-emission medium- and heavy-duty vehicles by 2025, in addition to investments in vehicle procurement, an investment of about $350 million in charging and refuelling infrastructure would be required.

Opportunity #8: At the provincial level, charging infrastructure incentive programs could become more useful if funding were expanded to directly target freight vehicles, with flexibility for private, single-use access, and to ensure coverage of higher-powered stations.

Opportunity #9: Buildout of publicly accessible charging and refuelling infrastructure along national highways or provincial or municipal roads could be done in co-ordination with relevant stakeholders in the goods-movement sector to keep their charging needs in mind.

Fleet capacity

A lack of readily available information continues to be a major barrier to ZEV deployment. Fleet operators need to be equipped with accessible, easily digestible resources to support effective decision-making, including information on total cost of ownership, vehicle procurement, infrastructure requirements, and GHG emission reductions. In addition, training needs to be provided for drivers and maintenance workers.

Opportunity #10: Investments in labour market programs to support good paying jobs and this new energy system are essential for the successful deployment and maintenance of zero-emission vehicles in commercial fleets, especially as the sector moves to scale up from pilot to mass adoption.