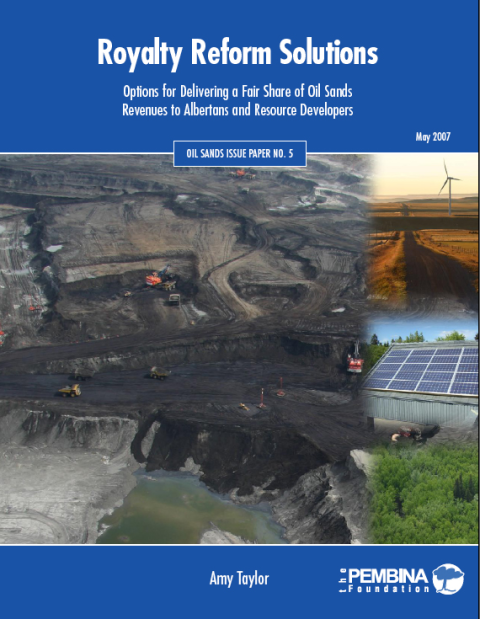

This report describes several options that Albertans, when thinking like owners, can consider for reforming the oilsands royalty regime. The reforms are designed to ensure better value to Albertans while maintaining a reasonable profit for oilsands companies. Updated May 24, 2007.

Recommendations

The Pembina Institute recommends that the oil sands royalty regime be reformed such that governments capture 70% of available revenue through taxes and royalties. This can be done while maintaining an internal rate of return for companies that is greater than 12%.

In this report, the Pembina Institute presents three options for royalty reform that meet these criteria; changes should be made for new projects, including those currently in the approval process, immediately and phased in for old projects over time.

- 55% Net Royalty

- 3-Tiered Royalty

- Polluter Pays

The Pembina Institute also recommends that at least 50% of resource revenues from the oil sands be placed into a long term fund to be used to cushion the Alberta economy from boom and bust cycles, as a store of wealth for future generations and to facilitate a transition to a sustainable energy future for Alberta.