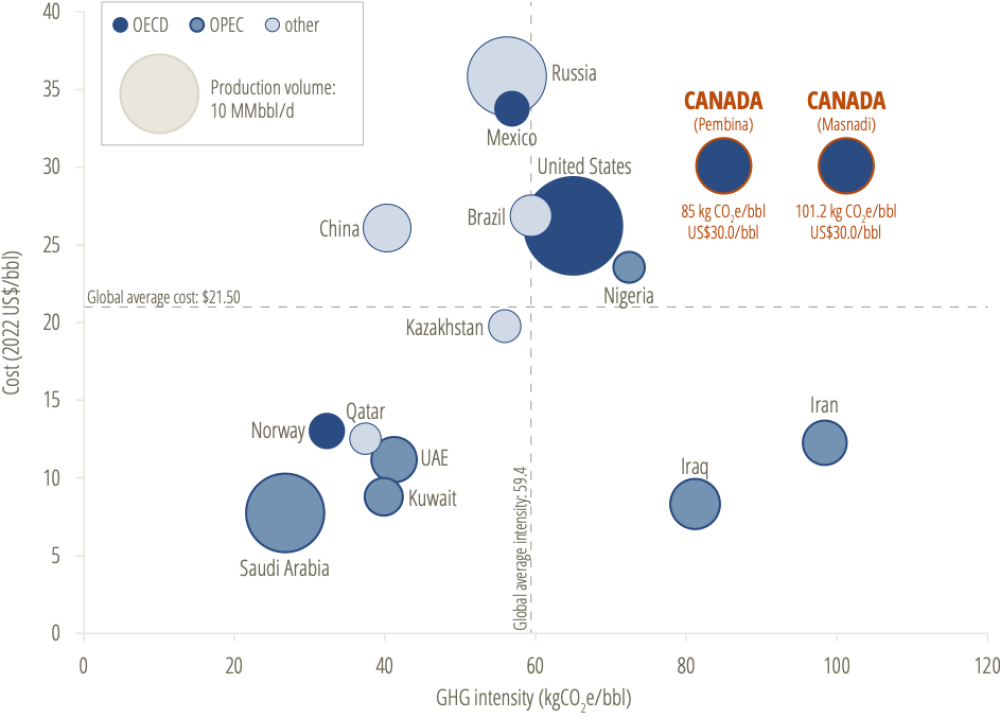

A new Pembina Institute report, Survival of the Cleanest: Assessing the cost and carbon competitiveness of Canada’s oil, co-authored by Janetta McKenzie, Scott MacDougall and Eyab Al-Aini, shows that Canadian oil remains well above global averages for average carbon emissions and breakeven price. Production costs per barrel of oil are an average of $20 globally, while in Canada the average is US$9 higher. On the other key metric, emissions intensity, Canada is well above the global average. It’s at 85 kgCO2e (kilograms of carbon dioxide equivalent per barrel of oil) while the global average is 60 kgCO2e.

The Pembina Institute looked at 36 major producing oilfields in Canada, representing about 62% of all Canadian production, 92% of Alberta’s production, and all offshore production. Some projects compared favourably on cost and carbon with global averages. However, most Canadian projects are well above global averages on both price and carbon.

The report concludes that public funding should be spent on reducing the carbon emissions of facilities that will be competitive in a low-carbon world, and bypass those that are at risk of becoming stranded assets (economic assets that lose value or turn into liabilities before the end of their expected economic life.)

Recommendations

- An emissions cap on the Canadian oil industry is necessary to spur investment in oil that has a lower emissions intensity and lower costs and can therefore compete favourably in global markets.

- Government incentives such as the federal CCUS investment tax credit are key policies to kick-start investment in large, capital-intensive solutions like CCUS, but care should be taken not to over-incentivize these projects beyond this limited tax credit.

- Investors will also need to account more strategically for carbon competitiveness in assessing the risk of current investments and evaluating future investments. The work of the Sustainable Finance Action Council will help with this, as will a government-backed Climate Investment Taxonomy to help guide investors with practical advice

- Finally, the Alberta government must prepare for a world in which the value of its oil reserves is greatly diminished. The Alberta government must implement policies that will reduce emissions and prepare oilsands assets to survive in a world of declining oil demand. Implementing strong methane regulations that achieve a 75% reduction in oil and gas methane by 2030, and reducing the legislated oilsands emissions limit — both included in the province’s emissions reduction and energy development plan — can complement key federal policies like the federal oil and gas emissions cap to incentivize investment in decarbonization.