Has a single straw ever actually broken a camel’s back? That this philosophical question applies to current events in Alberta’s electricity system may surprise you. So might the answer.

The issue is the recent termination of unprofitable power purchase arrangements (PPAs) by major energy companies (PPA buyers) and their justification for foisting these liabilities onto the public.

What does it mean that companies are terminating PPAs?

PPAs are leftover from deregulation at the turn of the century. Power plant operators were kept whole by keeping their revenue rates assured by contract (as a side note: this is why most of the ongoing threats about coal plant “confiscation” and fear-mongering about the costs of buying out “stranded assets” from the phase out ring hollow to us, given that the operators have been afforded set revenues for the periods deemed necessary to receive a return of invested capital). The government auctioned the PPAs off to buyers who have to pay coal plant operators both capacity payments and set rates for energy produced. The competition was weak and some PPAs — including those for the Genesee coal plant — failed to attract any bids.

PPA buyers are currently “terminating” their unprofitable coal PPAs. “Terminating” really means they’re returning the PPAs to the Balancing Pool — a Crown agency — to manage in the public’s interest. In other words, so long as they were raking in profits, the windfall was for the PPA buyers’ keeping, but as soon as they became worse than worthless (a net loss) the public takes the hit. We saw ENMAX start the trend in January, followed by TransCanada earlier in March and Capital Power in late March.

Why are they allowed to do this?

Well, it’s not 100 per cent clear they are. The PPA buyers are allowed to foist the PPAs back onto the Balancing Pool if there is:

- A Change in Law; and

- That Change in Law could reasonably be expected to render the PPA buyers’ remaining performance of the PPAs unprofitable to the buyer.

When those two conditions are met, the buyer can toss the hot potato back to the Balancing Pool without paying the Balancing Pool to take it.

PPA buyers have argued the recent increases in the carbon price under the Specified Gas Emitters Regulation (SGER) — the carbon price the Stelmach government initiated — satisfy number one. But do the SGER increases “render” the PPAs unprofitable for the buyers? That’s an interesting question.

What really caused these PPAs to become unprofitable?

I hate to pull out the dictionary here, but “render” means to “cause to be or become.” Did the SGER carbon price increase cause the PPAs to become unprofitable to the buyers? Resoundingly, NO.

PPA buyers’ revenues from the PPAs rely on the power pool price. For most of the lives of the PPAs they made a killing. The pool price has afforded revenues well beyond the PPA buyers’ fixed costs under the PPAs; so much so, that the whole deregulatory regime may have engineered a considerable wealth transfer from the public to private industry, as most commentators believe the net profits have provided windfall rents to the PPA buyers well beyond the public’s auction receipts. But recently, this changed dramatically.

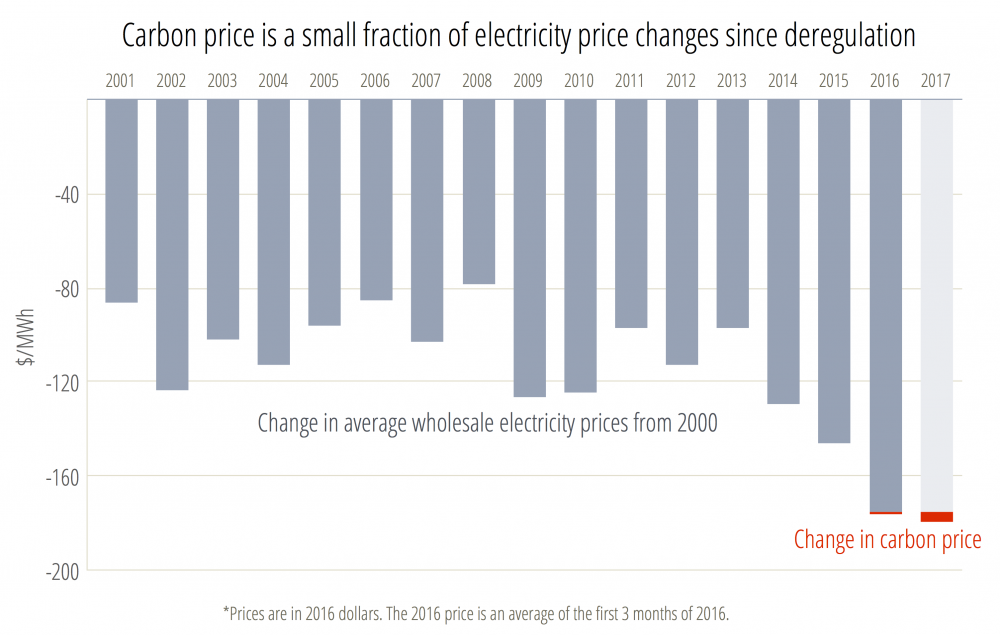

The graph below shows one egregious example. TransCanada bought the Sundance A PPA in August 2000. The graph sets the power pool price in 2000 as $0 and then shows in grey the change in average annual power pool price from 2000 (adjusted for inflation) for every year since. Like the other PPA buyers, TransCanada claimed the increase to the SGER caused the unprofitability. The graph also shows the magnitude of the SGER increases in red in 2016 and 2017, the only two years left under the PPA. This change pales in comparison to the precipitous decline in power prices in 2015 and 2016. The drop in power prices from 2000 is 60 times the average cost increase of the carbon price. Premier Rachel Notley’s assertion the SGER increase has had a “very marginal impact” on the overall PPA profitability might actually be an understatement.

There really is no magic to legal interpretation — the “plain meaning” carries the most weight. So, which do you think really “rendered” the PPAs or “caused the PPAs to become” unprofitable? The drop in power prices or the miniscule increase in carbon price? If you do hold the carbon price to blame, what does it tell us about the coal industry when paying for just a portion of its climate externality — coming to only $2.70/MWh — sends it over the edge?

So, why might the PPA buyers be allowed out of their PPAs?

The Independent Assessment Team (IAT) carried out the deregulatory PPA transition process. As Professor Nigel Bankes explains in detail, the IAT was asked by potential PPA buyers to clarify the “render … unprofitable” language. The questioners acknowledged a “literal interpretation” of the language would preclude a buyer from “exercising its right to terminate the PPA” if the PPA was “already” unprofitable. In that case, by a plain reading of the provision, the Change in Law would not have “rendered” it unprofitable and the buyer would have no right to terminate.

But something bizarre happened. The questioners asked for a clarification that the language really meant to include a Change in Law that renders the PPA “more unprofitable.” The IAT acquiesced, reading in an adjective that didn’t exist! Even though, as Professor Bankes says, this “hardly seems to be a commercially reasonable conclusion — let alone the ‘obvious’ intent of [the PPAs].”

So, where does this leave us?

Having caved, the deregulation apparatus created expectations among PPA buyers. If the Klein government’s deregulation regime succeeded in defining “render performance of the contract unprofitable” to mean ever so slightly more unprofitable it is a remarkable concession. It would allow the PPA purchasers to foist downside market risk onto the public for even the slightest change in law, as they are now attempting. If this is the last word — which isn’t yet clear given the Balancing Pool’s opportunity to contest the terminations and any consumer’s potential right to challenge the Balancing Pool if it accepts the PPAs without a fight — it does not reflect well on the process of deregulation.

Did a single straw break the camel’s back? Clearly not. If, after years of significant profits, the PPAs are now unprofitable it is a result of the power market. To get out of them scot-free, the buyers have to claim it is the SGER increase rendering the PPAs unprofitable, despite the plain evidence to the contrary. That the law might agree is a bizarre twist of the deregulatory regime’s decisions to allow the PPA buyers to pass downside market risk to the public. As we try to deal with coal’s legacy of using our atmosphere as a free dumping ground, we now unfortunately have to navigate the burden of these earlier follies.